WIDELY CONTESTABLE, INDEPENDENTLY SUPERVISED DATA

- COMMON INDUSTRY DESIGNED STANDARDS OF CONDUCT AND REPORTING

- CLEAR BID, ASK & TRADE TIMESTAMPS; LENGTH OF INDIVIDUAL ORDER VALIDITY AND EXTENT OF INCREMENTAL PRICE LEVEL TESTING BOTH VISIBLE (TO THE SECOND)

- BROAD-BASED EXPERT SCRUTINY BY MARKET PARTICIPANTS

- INDEPENDENT MARKET SURVEILLANCE AND INTEGRITY MONITORING, TAILORED TO MEET THE NEEDS OF A PHYSICALLY DELIVERED OTC MARKET

- POST-EXECUTION TRACKING OF TRADE PERFORMANCE

UNPARALLELED INSIGHT INTO DRIVERS BEHIND HEADLINE PRICE LEVELS

- PRICES NORMALISED TO READILY COMPARABLE HEADLINE GRADES BY EXPERT MARKET PARTICIPANTS IN THE COURSE OF TRADING (REDUCING RELIANCE ON JOURNALISTIC INTERPRETATION AND DISCRETION)

- FULL TRANSPARENCY OF UNDERLYING CONTRACTUAL TERMS INFORMING INDIVIDUAL BID & ASK PRICES; HIDDEN CONTRACTUAL OPTIONALITY ELIMINATED

- MATERIAL DIFFERENCES BETWEEN PHYSICAL ORDERS THAT MIGHT OTHERWISE LOOK IDENTICAL ON THE SURFACE ARE IMMEDIATELY VISIBLE

ADDITIONAL OBJECTIVE TRANSACTION-BASED PHYSICAL DATA POINTS

EXECUTABLE BID-ASK SPREADS CREATED BY ‘MATCHED’ OTC COUNTERPARTS IN THE COURSE OF NEGOTIATING REAL PHYSICAL BUSINESS … REDUCING RELIANCE ON DIFFICULT TO VERIFY SUBJECTIVE TRADEABLE VALUES

ASSURANCE AGAINST SELECTIVE REPORTING

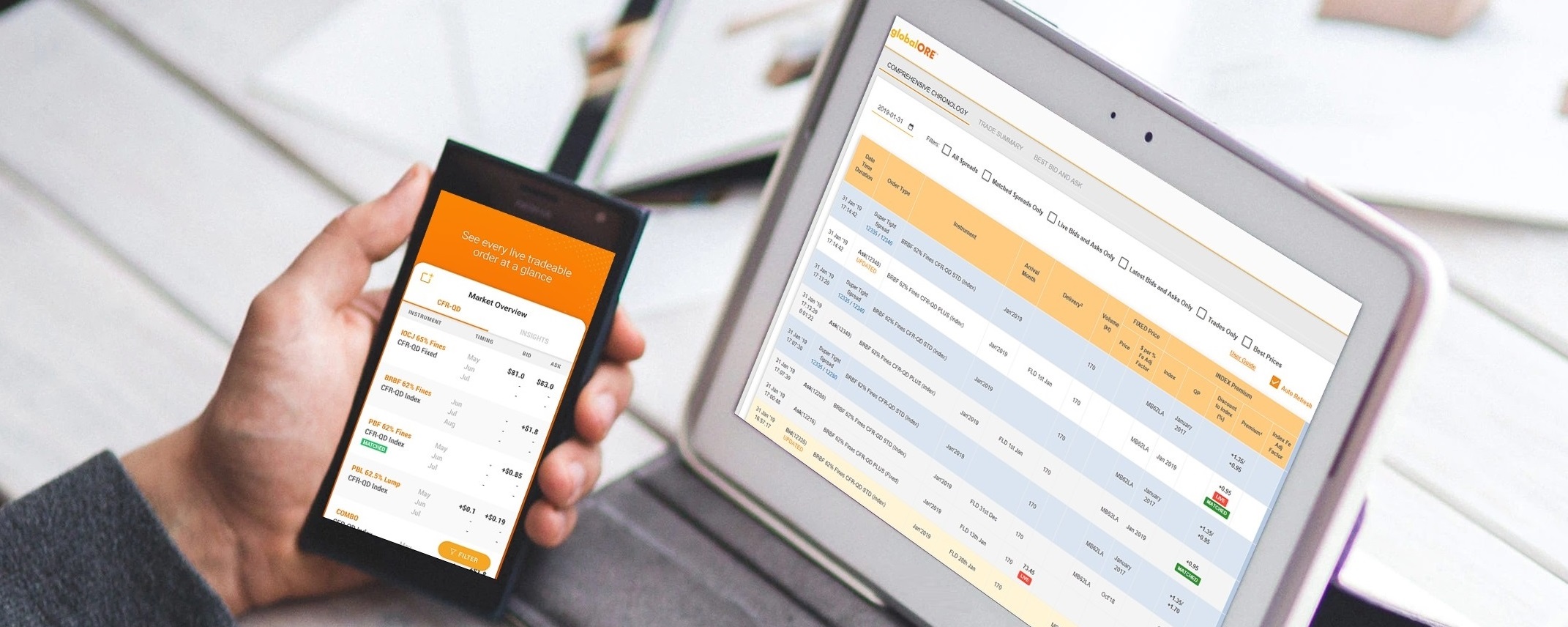

EVERY PHYSICAL BID, ASK SPREAD AND TRADE … VISIBLE IN REAL-TIME … AND EXPORTABLE FOR DEEPER ANALYSIS AND RECORD KEEPING … INDEPENDENTLY ASSURED BY A NEUTRAL VENUE UNENCUMBERED BY INTEREST IN TEMPORAL PRICE LEVELS OR PARTICULAR INDEX METHODOLOGIES

IDENTIFY AND MANAGE DIFFERENCES IN TRADE PARTICIPANTS’ MARKET STANDING AND BUSINESS MODELS

UNPRECEDENTED INSIGHT INTO THE DEPTH, BREADTH AND MARKET STANDING OF BUYERS AND SELLERS THAT ARE ABLE TO TRADE INDIVIDUAL OTC ORDERS … CREATING A NEW OBJECTIVE FRAMEWORK FOR ASSESSING THE EXTENT TO WHICH INDIVIDUAL BIDS, ASKS AND TRADES REFLECT WIDER PHYSICAL MARKET FUNDAMENTALS

To enquire about becoming a Market Member or Subscriber, please contact +65 6539 0550